U.S. crude oil production exceeded 10 million barrels per day (b/d) as of November 2017. That was the first time since 1970 that monthly U.S. production levels surpassed 10 million b/d. Steadily increasing oil and gas production in the USA has been a factor in the lowered price of oil (since about 2015). Strictly speaking, one would not view American output as over-production (they still need to import oil to meet their needs). But that level of production takes enough of a bite out of the volume of oil sold that OPEC decided to increase their production, thus lowering profits of the expensive-to-produce North American hydrocarbons.

The lowered prices have not affected the USA production, which averaged 10.93 million b/d in 2018, but is has been a gut-punch to Canadian production and particularly to our most voluminous resource, heavy oil. With the differential considered, it is difficult to imagine what world price is needed to make Alberta work again.

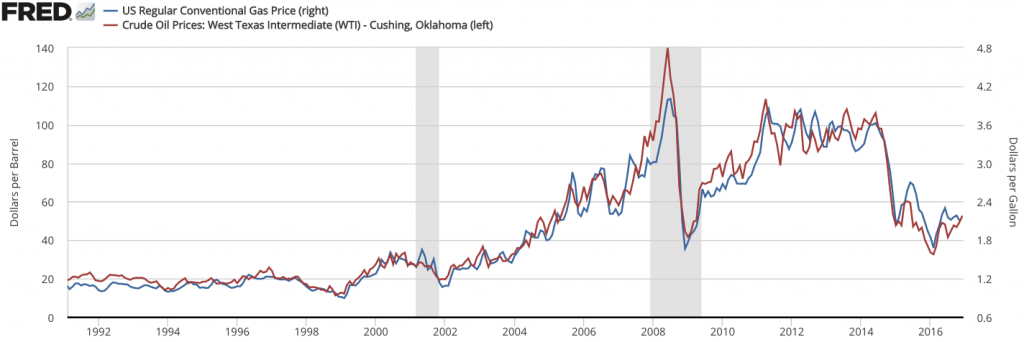

Here is a graph of US oil prices. Alberta did pretty well from 2000 all the way to 2015. The 2009 drop did slow things down for a year, but that was short lived as oil returned to $90 / barrel.

What price do you think we need to see Alberta’s oil and gas sector come to life again? What if the differential were not so large a gap? What if we had a market for Natural Gas, which we sell well below its world value? What factors and considerations have I not mentioned?